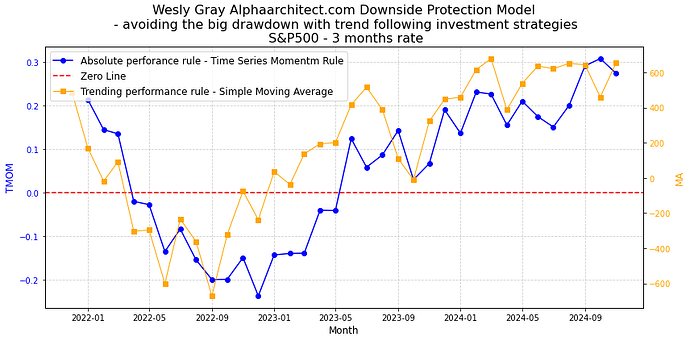

un autre indicateur généré en suivant l’article de Wesley Gray de Alphaarchitect;com

« avoiding the big drawdown with trend following investments strategies ». Il nomme ce modèle le Downside Protection model qui suit 2 règles simples: Time Series Momentum Rules (TMOM) et Simple Moving Average Rule (MA).

Absolute Performance Rule: Time Series Momentum Rule (TMOM)

o Excess return = total return over the past 12 months less return of T-Bills

o If Excess return >0, go long risky assets. Ogherwise, go long alernative assets (T-Bills)

Trending Performance Rule (MA)

o Moving average (12) = average 12- month prices

o If current price minus Moving Average (12) >0, go long risky assets. otherwise, go long alternatives assets (T-Bills)

Combining the 2 rules: trigger one rule, go to cash 50%. Trigger both rule, and go to 100% cash. No rules triggered iplied 100% long risk.

Ci-après le graphe des 2 règles en utilisant l’indice SP&500 (^GSPC) pour le risky asset et l’indice le 3 months rate de la fed (^IRX).

1 « J'aime »