Un exemple d’allocation dynamique basée sur une mesure du momentum par Andrea Clenow. Il s’agit juste d’un exemple qui peut servir pour vous inspirer votre propre stratégie d’allocation.

A Simple Way to Increase Performance

It doesn’t have to be hard or complicated to create performance. Simple concepts are usually the most reliable. This time, I’d like to tell you about a little trick that can enhance most portfolios. I find it easiest to explain by showing you an example.

Let’s Start with the All Weather Portfolio

Just to isolate the effect, I’ll use Ray Dalio’s All Weather Portfolio as a starting point. As a quick reminder, this portfolio holds 30% stocks, 40% long term bonds, 15% medium term treasuries, 7.5% gold and 7.5% commodities. I’ll use ETFs to allocate to these buckets, and rebalance monthly.

Improving the Model

The All Weather Portfolio is really not a bad model. From a risk adjusted point of view, it massively beats regular stock indexes. I’ll keep almost all of it in my improved version. All I’ll do is to measure momentum once a month, and then toggle the weights up and down slightly based on that. At the most extreme negative momentum, I’ll half the default weight and at the most extreme positive I’ll double it. Then we normalize the weights, so we’re back to 100% in total. That’s it.

What do I mean by Momentum?

There are many way to measure momentum. Some bad, some mediocre and some pretty good. I’ll use my own aptly named Clenow Momentum analytic. This calculates exponential the regression slope, in this case for 90 days, and multiples by the R2. This gives us a momentum, adjusted for trend strength.

Results Speak for Themselves

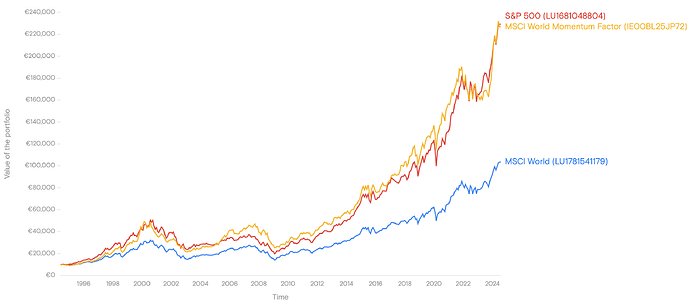

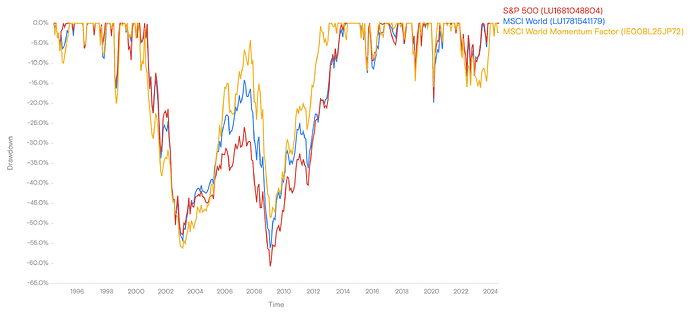

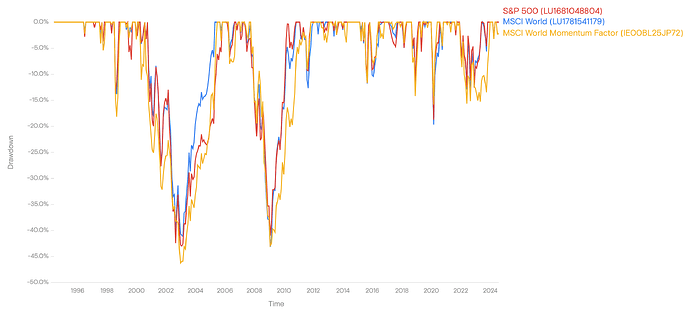

Below you see the S&P 500 in black, the standard All Weather Portfolio in purple and our new dynamic version in gold. First, even visually you can see how the standard AWP greatly outperforms the market. Second, the momentum based dynamic version has a slow and steady outperformance against the standard version. But visual inspection can be deceptive. Let’s check the numbers.

The Sharpe ratio is not perfect by any means, but it does tell a clear story here. The S&P may have the highest return in the end, but at the cost of very high risk, deep drawdowns and a horrible Sharpe. The standard AWP model does far better. But the really important thing here is how much our momentum based AWP outperforms. A full percent better performance, lower drawdown and nearly ten points higher Sharpe. That’s a massive increase.

Ceci est un exemple parmi d’autres d’une stratégie d’allocation dynamique basée sur

une mesure du Momentum. Elle est proposée par Andrea Clenow